Dividend Investing

For beginners

Investing in stocks for their dividends is one of the best ways beginners can get their feet wet investing in the stock market. Actually many experienced investors buy stocks for their dividends, it’s a very safe way to invest. A large portion of publicly traded stocks pay quarterly or annual dividends and many raise the payout every year.

There are many strategies that can are played with dividend investing, for example waiting until a high dividend paying stock price drops, then buying up shares. Another strategy would be to try to buy before the ex-dividend date (I’ll explain what this is), then sell afterwards in an effort to “collect” dividend payments from several companies. There are many more dividend strategies that can be employed but this article will cover the basics of buying a stock or ETF in order to receive regular dividend payments.

How much do companies pay?

Dividends are not a get rich quick kind of investment but because companies steadily increase dividends over time payouts can really become large. Most of the established companies pay about 1.5% on the low end to about 4.5% or so. Some pay more and some pay less. A little trick to get a higher percentage (mentioned above) is to hold off purchasing the stock until the price drops. That way the stock is obtained a cheaper price while still paying the same dividend.

Also, as mentioned above, its very important to note that most companies raise the payout every year like clockwork. That means that if an investment is held for the long term, it is very possible to receiving 10% or more, especially of the company splits its stock or goes through a strong growth period

Which stocks pay dividends

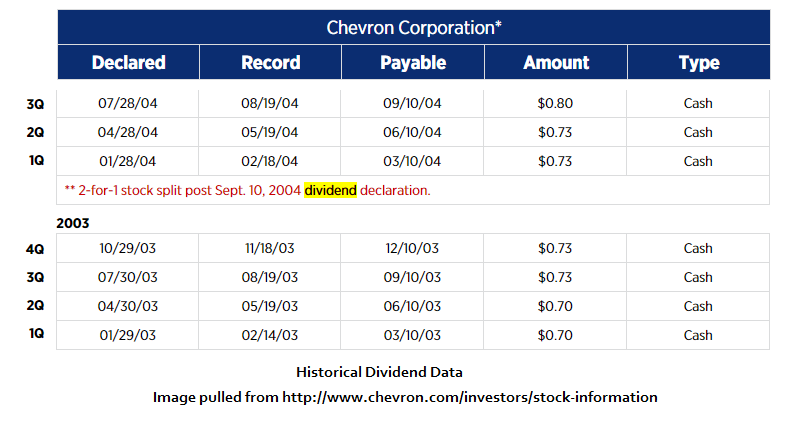

Check out the 30 companies listed on the Dow Jones or the S&P 500. These are generally very good quality companies and most pay out a quarterly dividend. To see if a company pays a dividend simply google the stock ticker of that company. The above images are the results of google searches. Now there are companies of lesser quality that may pay out larger dividends but a general rule to follow here is never buy stock in a junk company. If they are not a big, stable company with a long track record of growth and a long track record of dividend payments, pass. There are too many good companies to buy that it’s just not worth the risk. Remember, buying a stock is literally buying a small piece of ownership in that business. Some ETFs also pay out a dividend.

How to buy stock

Most investors large and small use online brokers. Signing up at one of the online brokers is very easy. After opening an account, funds can then be deposited into the online brokerage account. After the funds clear, stocks or other investments can be purchased. This online account is where dividend payments will be deposited. There is normally a fee associated with the buying and selling of stocks but it is much less expensive today than it was before online brokers took over. The fees generally range from about $5-8 dollars per trade regardless of amount of shares purchased. These fees have been steadily falling and most are around the $5 mark now. Here are some of the most known:

- E-trade (recently purchased Options house)

- TD Ameritrade

- Fidelity

- Charles Shwab

- Trade Station

- Many more…

Most of these are going to be the same except for the transaction fees and services they provide. For general investing purposes I would suggest going with a broker with lower transaction fees. Many banks offer brokerage services as well.

How to get dividend payment

That is the easy part. After opening an account at an online broker and purchasing stock in a dividend paying company, the dividend is deposited right into the brokerage account. There is nothing extra that needs to be done outside of just owning the stock. At that point the dividend can be withdrawn to be spent or reinvested into more dividend paying stocks.

Important Dividend Dates

There are 4 important dates when it comes to dividend investing. If your purpose it to own the stock for a long period of time, you can go ahead and skip this section. These dates are the EX-dividend date, Record Date, Declaration date and Payment Date.

Ex-Dividend date

This is the only date that really matters. The Ex-dividend date is always 2 business days before the record date. Stocks must be purchased BEFORE this date to receive the upcoming dividend payment. If they are purchased ON or AFTER this date then the owner will not receive that dividend payment.

Record date

The Record date is when a company records who owns the stock in order to know who to gets the dividend. This date is important because in the United States, stock transactions are settled 3 days after the transaction. That means that people who buy a stock ON the Ex-dividend date are not eligible to receive that dividend date. But buyers who purchase before the EX date do receive the dividend. Remember the Ex date is set 2 days before the Record date.

Declaration date

This is when the company announces the Record and ex-dividend dates, along with the day the payments will actually be sent out.

Payment date

This is when the payments will be deposited into brokerage accounts.

Where to do research

Most companies can be pulled up right over google by typing in their ticker symbols. If you do not know a company’s ticker symbol, simple type in the company name and the words “ticker symbol” right into google. Normally google will only provide the current dividend yield. To dig deeper, check out dividend.com which will provide several years of dividend data for a given company.

Now normally I would advice doing some financial research about a company to determine if its worth your investment dollars but that is outside the scope of this article. That kind of research is for those investors who want to look at whats off the beaten path. The Dow Jones 30 is a list of top companies and is perfect for general dividend investing and will keep you within the safety of “the sandbox.” Picking companies form this list would be an excellent start.

Some Rules to Limit Risk

Safety first is always a good motto, especially when money is on the line. While there are many strategies and ways to profit in the stock market and some strategies may veer away from the path of safety, following a few rules will greatly reduce the odds of losing money. First a note from our friend Warren Buffet:

Buffets 2 rules:

- Never lose money

- Refer to rule number 1.

But seriously here are a few really simple rules to live by that will save you headaches. The first one is the most important:

- Never buy stock in a junk company.

- Never follow the advice of “professionals.” If you’re going to play this game do your own research.

- Wait until the stock is selling at a bargain price to buy it (unless you’re dollar-cost-averaging).

- Never buy stock in a company you do not understand and cannot explain to a 5 year old. (Warren Buffet)

Beyond

While there are many advanced investing strategies, dividend investing is a really great way to get your toes wet when it comes to investing in the stock market. It’s a great way to make some money in the stock market while learning more about how it all works, and it beats the heck out of leaving money in the bank. I hope this was a good overview to begin investing in stocks for their dividends and I wish you good luck!