Invest in Stocks, not Savings Accounts

Your money should be making you money

In this article I will explain several ways to make money with your money. Ways that they should be teaching everyone in school. This includes regular quarterly dividend payments, right into your account, to franchises and businesses.

MONEY DEPOSITED INTO YOUR ACCOUNT… FOR LIFE

Verizon pays 4.5% yearly dividends, Starbucks and Disney both pay about 1.5% dividends, and shell oil pays about 6.5% dividend. All of these stocks are less than $100 each, Verizon and Starbucks are closer to $50 each. Now for the fun part – how much can you save per month? How much do you spend on things you don’t really need? Let’s say you can save $1000. Buy $1000 worth of any of those 4 stocks. Verizon will pay you $45 bucks per year, every year, for the rest of your life (assuming they don’t go out of business). Starbucks and Disney both pay closer to $15 bucks and Shell Oil would pay about $65.

HOW MUCH MONEY CAN YOU SAVE PER MONTH?

Investing begins here

The above paragraph is a real investment example of how you can add a few hundred dollars to your income for the rest of your life. There are lots of stocks out there right now, safe big blue chip companies with long histories. They will pay you dividends every quarter. They will literally, deposit money right into your account. Money that you can withdraw and spend. I don’t know why they don’t teach this in school.

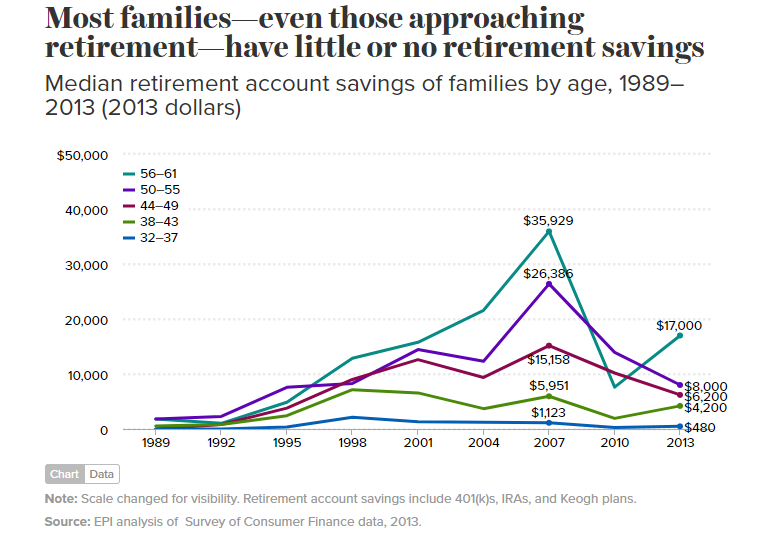

Most people have almost nothing invested, and I wonder why? Its not something they teach in public schools and the first time most people even consider investing is when they get their first job offering a retirement plan! That is pure craziness. People should be investing from the first dollar earned… because money makes money.

All of this is very practical and can be started right away.

ITS IMPORTANT TO PICK BIG, SOLID COMPANIES

This is super important. Rule number one in investing is to pick solid companies with long track records of growth. This is a super important rule. Even if an investment goes south for a while, if the company is a well chosen solid company, chances are its only waiting game before it rebounds. If you really tried could you save $5000 in one year? Put that in one of those stocks, or a bit in each, and be paid $225 per year every year for the rest of your life by Verizon, $75 by Disney and Starbucks and $325 per year by Shell! The reason I picked large known companies is that they are safe and will most likely be around for a very long time.

DON’T FORGET THE BONUS – MARKET GROWTH

The long term history of the stock market shows that it increases over 10% per year since its inception which means that not only will you be receiving dividends, deposited right into your brokerage account, but the value of the stock may increase as well, so that’s kind of a double dip. Years down the line if you decided sell you have a strong possibility of making much more than what was first invested.

ANOTHER BONUS – INCREASING DIVIDENDS

On top of that most companies increase their dividends every year! Yes, they increase their dividends. The $1000 invested 10 years ago in Verizon is now making way over 4.5% on their dividends. A quick look over at Verizon’s dividend history shows that if Verizon were purchased at the end of 2013, which paid about 5% dividend at the time, would be about 6% now (2017) and will keep on increasing year after year, depositing ever increasing amounts in your bank account for doing absolutely nothing.

WISDOM FROM THE SAGES

If you decide to invest in individual stocks like I, and many others do, it is important to heed the advice of the ones who’ve gone before. Never buy stock from junk companies unless you really know what you are doing. Buffet is always preaching the importance of buying good companies. This is the single most important step before buying stock, in my opinion. Read up on successful investors like:

- Peter Lynch

- Warren Buffet

- Philip Fisher

- Joel Greenblatt

- and many more…

They will offer this same advice.

Anyway, that’s just one way to shove money into something that will literally pay you every quarter. That is real money right into your brokerage account. I personally have been doing this for about several years now, though I’ve started to try to make money on stock fluctuations as well, though that game is certainly not for everyone.

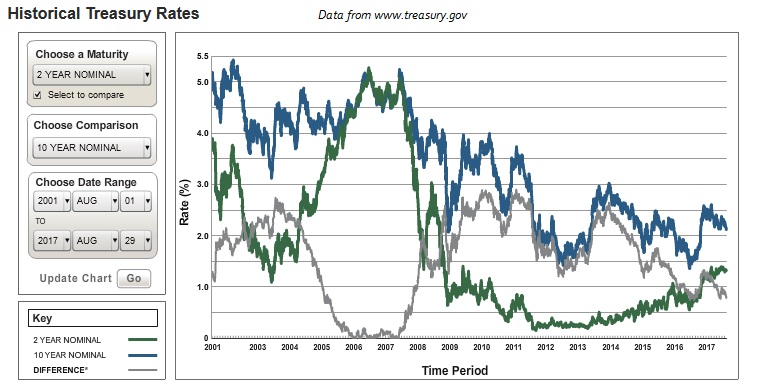

BONDS, CD’s AND MONEY MARKET

The yields are much lower in these markets but they are extremely safe provided you stay away from junk bonds. For example, the only way to lose money on US Treasury bonds would be if the US government failed. The interest rates are so pitifully low right now (2017), I wouldn’t recommend stuffing money away here, unless it is for diversification purposes. Treasury.gov is a great source to research the current rates.

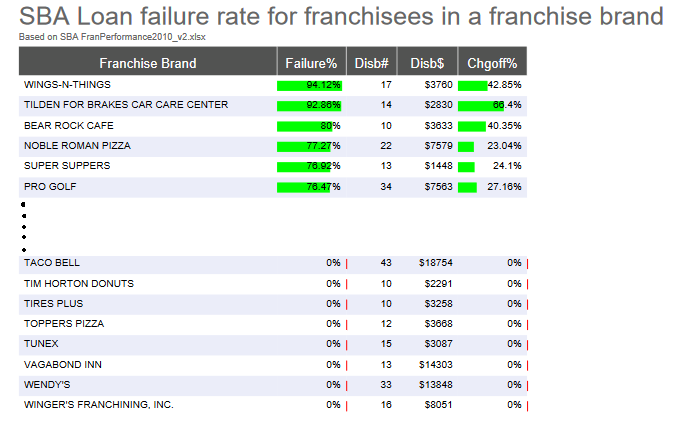

BUY A FRANCHISE

I would highly recommend looking into buying a franchise. Here is a nice little link to the franchise loan default rate as reported by the small business administration. Most have minimum capital requirements but some are very low, in the $20k range. It may take a while to save that amount up, but once you do, you can be running a proven business model and start to walk away from your 9-5 job. Many people have found financial freedom in running one, or many franchises. Below is an excerpt of data collected through the SBA.

There are many entries but I cut off the top and bottom to give an idea. For those serious about franchising, an exhaustive list of loan information can be found at the 504 Loan Data Reports. The full list below is also downloadable here.

START A BUSINESSES OR TRY OUT AN IDEA

Seriously, try something you think would work, or something that’s been rattling around in the back of your head. I promise this will be money well spent. If you have the time and ability, why not? Pinch pennies for a while, get a second job, whatever it takes to get the needed cash up to try it out. Later on I will make a post with the many books I’ve read and other articles I’ve found about people doing just that. Ideas should be tried out!

HYDROPONIC TILAPIA FARM

Earlier this year I was reading an article about a new area of entrepreneurship. People are starting hydroponic greenhouses and using the waste from tilapia, which reside in the water, to feed the plants. It looks like an area of opportunity to me. Anyway, if you can try out an idea in a small way at first, without breaking the bank, to kind of test the market, by all means do it! This is money well spent.

THAT’S HOW I STARTED

That’s exactly how I started. I ran a lawn care business that was started from pretty much scrap. I built a website, did some SEO, passed out fliers, etc., until I got my client base up and had 30 or 40 lawns I would mow every week. It was nice and I made my own money. This eventually turned into another business altogether which did much better and allowed me to buy my first home.

DON’T FORGET ABOUT REAL ESTATE

Many fortunes have been made in real estate. I would highly advice checking out Dave Ramsey if you are interested in venturing in this area of investment. He teaches about “stealing” properties. No not literally stealing them but getting amazing deals is the real way to make money in real estate. A bit of start up capitol would be necessary to buy the first property but if focused penny pinching is done right, it shouldn’t take to terribly long.

CONCLUSION

Stop settling for where you are in life, especially if you are not happy. Turn your ears off to all the skeptics, especially if they are in the same boat! There are so many ideas and business out there that are still uncovered. Stocks, bonds, real estate, business and random ideas coupled with personal discipline really do yield an exciting and fulfilling life.