How to get huge dividend yields.

3 Case Studies

This article will follow 3 different case studies for 3 companies listed on the Dow Jones Index.

Holding dividend paying stock over the long haul pays, well, large dividends.

And don’t forget about stock splits, I will factor those in as well.

In this study will show what the quarterly payout would be today if the stock had been purchased 10 years ago.

There is nothing special about these 3 stocks – they are all large companies who pay regular dividends and are listed on the Dow Index. These are generally considered safe investments.

This study will show what happens as dividends rise over time. Most companies steadily increase their dividend payout every year.

Then I will show what the payout would be if these stocks are held for 30 years, assuming the same growth rate.

I wont go into some of the secondary benefits of dividend investing, like stock growth, but will stick to the huge incentives of long term holding for purely dividend growth.

Lets start off slow with an investor favorite. The steadily increasing Verizon Communications Inc., which has a long history of rewarding investors with about a 4-5% annual payout.

Dividend Case Study #1

Verizon

Now if Verizon were bought today, it would pay roughly 4.5% annually, but what would the payout be if the stock were purchased 10 years ago and held? I will assume a $10,000 investment was made.

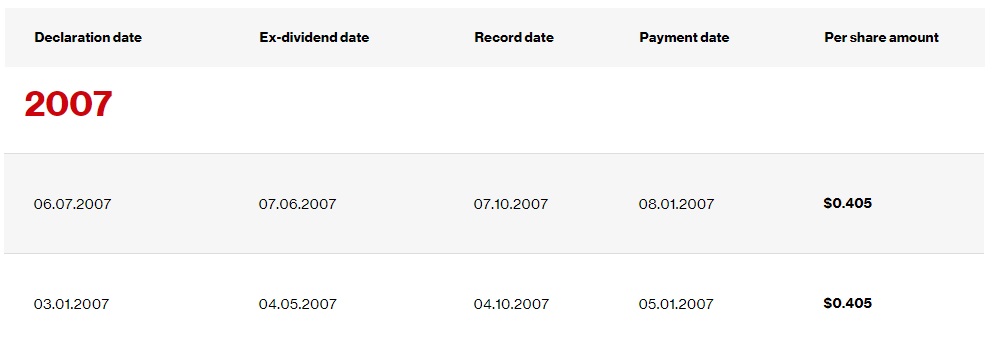

In 2007, Verizon’s quarterly payout was about $.405 per share and the stock could be purchased at about $35 dollars. That priced fluctuated throughout the year but it was about average for that time. A little math (.405/35X4) will show the annual payout to be about 4.5%, just like today.

For our $10,000 investment, that would mean an annual payout of $450 dollars.

Now what most people overlook is that most companies INCREASE the dividend payout every year like clockwork. Take a look at the 10 years since 2007.

Isn’t that pretty? Like most dividend paying companies, Verizon raises their payout every year. So what does that mean for the original $10,000 invested in 2007?

An investment of $10,000 would now be paying over $650 in annual dividends. Not a huge jump but pretty significant none the less. In about 10 years the dividend has jumped from 4.5% to over 6.5%. That’s over a 40% increase in dividend payout.

No need to try to time the market or rush around buying and selling. All the stock holder needs to do is sit back and collect the ever increasing dividend payout

What happens if this stock is held for a full 30 year period? Assuming the same linear progression we should expect to see dividend payments of approximately 10.5% which equates to $1,050 per year in payout.

That’s not too shabby, but let us take a look at a more aggressive example from the Dow List

Dividend Case Study #2

Mcdonalds

Ah Mcdonalds, I’m lovin’ it. McDonalds is a staple in many portfolios today.

Lets jump right with our $10,000 investment.

Mcdonalds 2007 quarterly dividend payout was $.375 per share. Shares were selling for about $44 a piece which means the dividend yield was about 3.4% annually.

Right off the bat, the payout would be $340 per year.

Take a look below see what Mcdonalds does over the next 10 years.

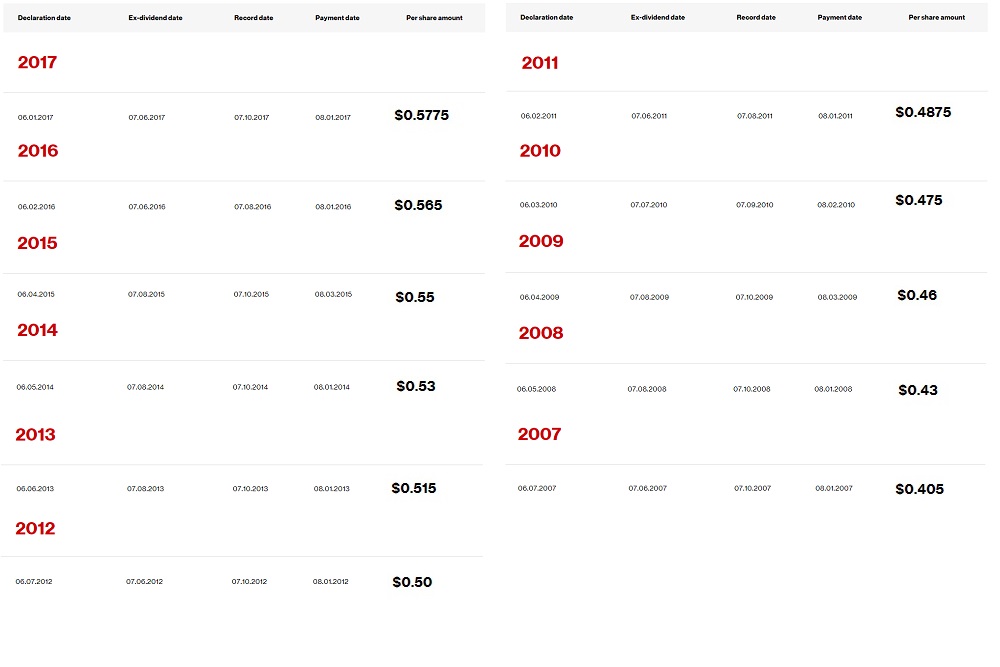

We are still a few months away from this year’s dividend raise but we can assume it will be between 4 and 5 cents so let’s figure in 4 cents to be on the safe side. We will assume quarterly payout to be $.98. That is $3.92 annualized.

Ok now lets see how our investment did in the past 10 years.

A little math (10,000/44X3.92) reveals a payout of $890 per year! That is an annual dividend yield of 8.9%. Okay that’s not bad at all. Now lets see what happens if this position is held for a 30 year period.

If growth remains the same, we can expect Mcdonalds to pay about $8.6 annually per share if we hold it for another 20 years (rounding out a 30 year period).

Hold on to your shoes, these numbers are going to be a bit staggering. If Mcdonalds were purchased 10 years ago, and held for an additional 20 years, making it a 30 year holding period, the dividend payout on our original investment of $10,000 would be yielding $1,954.54 annually. That is almost a 20% annual yield. Yikes.

One thing I have not mentioned yet is the additional bonus of the stock value growing along with the dividend. In Mcdonalds case, the stock is now valued at over $150/share.

Not only could this company be held for its dividend but Mcdonalds stock could also now be sold at a handsome profit.

At this point I think the picture starts to become clear. Slow and steady companies like Verizon pay a nice upfront dividend and increment dividends at a slower yearly pace. Even so, Verizon still ends up paying over 10% annually over the long haul.

Companies like Mcdonalds start investors off at a lower annual yield and move dividend payments up at a more rapid pace. This investment ended up paying almost 20% annually after the long haul.

Lets take a look at yet another Dow Jones company moving at an even more aggressive pace. Here we will also experience the stock split.

Test Case #3

Nike

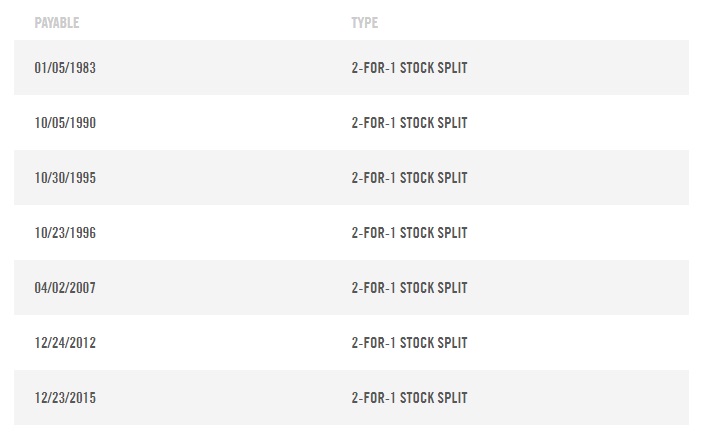

The last test case in this study will be Nike. Along with rapid dividend growth, Nike has also spit several times.

During our case study, Nike will split 3 times, all 2 for 1. That means for each share originally purchased, we will have 8 shares.

Lets dive in.

In the beginning of 2007 Nike was paying out $.046 per quarter or $.184 per year. Shares could be purchased at about $12.50 during this time period.

This equates to a 1.45% annual dividend. A mere $145 paid out annually on our $10,000.

Funny how big things sometimes come in small packages.

Lets take a look at what Nike does.

Just like the other case studies, we see a steady increase of the dividend every year except this year (2017) and that’s only because they have not announced it quite yet. There should be a regular increase in a few months’ time.

Now, a little math will show us how the investment would have done if held for 10 years.

This year the dividend (should be) about $.20 after the regular increment which is $.80 annualized. That means our investment of $10,000 would yield $640 per year, which is 6.4%.

BUT WAIT, we forgot to factor in the stock splits. Nike actually split 3 times. We can go ahead and multiply $640 by 8, because for every 1 stock held, we now hold 8.

Our actual yield is $5,120 or 51.2%!!

That is a mind boggling yearly return. Thanks Nike.

Conclusion

I hope these case studies have been informative. Investing in solid dividend yielding companies can really reap large returns over the long haul. I also hope that I’ve demonstrated how Dividend investing can be a highly lucrative investing strategy. This process can be repeated on any dividend bearing stock including any of those listed on the Dow Jones Index. As always, good luck with your future investments!